Let’s face it: in today’s business world, you have to make smart decisions, and fast. No more winging it! The secret? Rock-solid business processes and squeaky-clean financial data. As someone who’s been in the trenches – marketing, economics, and even a bit of computer science – I’ve seen what works. Let’s get into how you can make this happen for your business.

Why Bother Optimizing?

Think of your business like a finely tuned race car. Every process – from making sales to sending invoices – is a part of that engine. If one piece is rusty, the whole thing slows down. Optimization is like giving that engine a tune-up. The result?

- Less wasted time: Processes flow smoothly

- Fewer mistakes: Data is accurate

- Smarter choices: Decisions are data-driven

- More money: Efficiency boosts your bottom line

Truth is, many companies are still using old, clunky systems. It’s slow. It’s frustrating. And it hurts your ability to compete. Time to change that!

Business Process Optimization (BPO): What’s the Deal?

BPO is all about making your business run better. It’s about spotting the weak links in your workflows and fixing them. Think of it like this: you’re a detective. You gather clues (data), analyze the evidence (processes), and find the culprit (inefficiency).

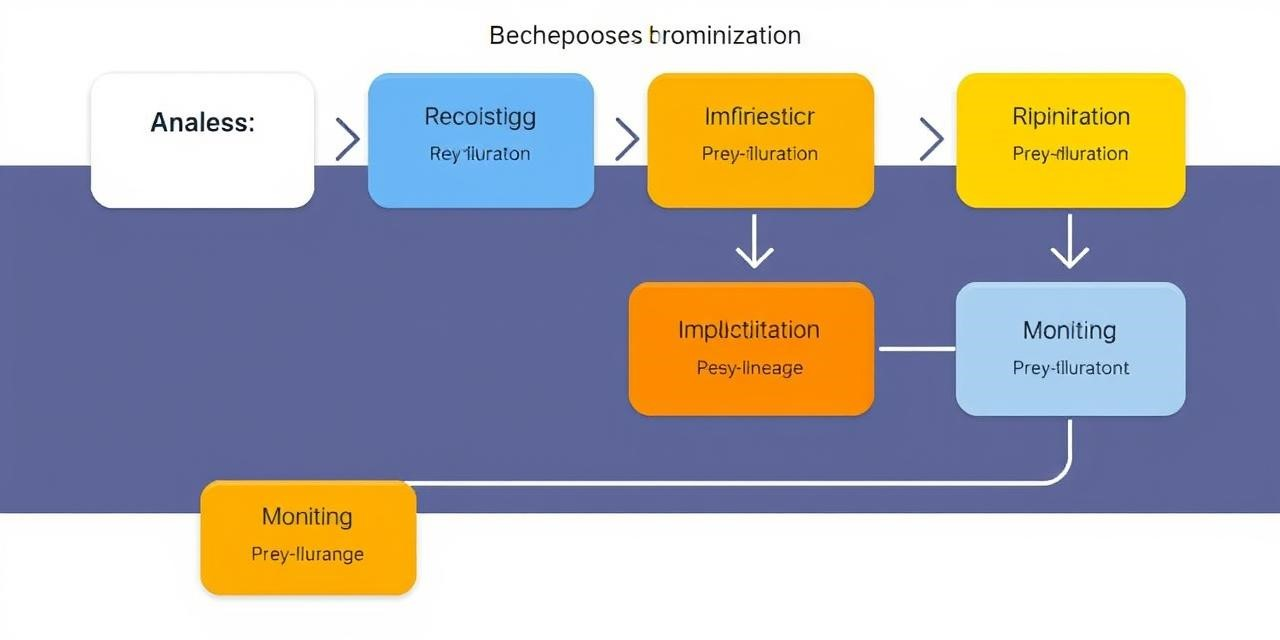

Here’s how it breaks down:

- Find the Processes: What are the key things you do? Order stuff? Onboard new customers? Report finances? Map it all out.

- Check the Performance: How are those processes actually doing? Where are things getting stuck? What’s the error rate?

- Redesign: Time to get creative! How can you fix the problems you found? Maybe you need to automate something. Maybe you just need to reorganize.

- Make it Happen: Put your new processes into action. Train your people. Update your systems.

- Keep an Eye On It: Optimization isn’t a one-time thing. You need to constantly monitor your processes and tweak them as needed.

The Untapped Potential of Financial Data

Financial data is the lifeblood of your business. It tells you how you’re doing, helps you make smart investments, and keeps you out of trouble with the regulators. You need to collect it, store it safely, analyze it, and report it accurately.

Here’s what that looks like:

- Gathering Data: Pulling info from sales, expenses, bank statements – everywhere!

- Storing Data: Keeping it safe and organized. Accounting software or a good database is key.

- Analyzing Data: Spotting trends, patterns, and – uh oh – problems. Reports, financial models, and variance analysis are your friends.

- Reporting Data: Creating those financial statements – income statements, balance sheets, etc. – that show everyone how you’re doing.

Data Analytics: Digging for Gold

Data analytics is what powers both BPO and financial data management. It’s about taking all that raw data and turning it into useful insights. It can help you find inefficiencies, spot growth opportunities, and make smarter decisions about where to put your resources.

Let’s say you notice a product isn’t selling well in a specific area. Data analytics can tell you why. Maybe people don’t know about it. Maybe the price is wrong. Once you know the problem, you can fix it!

Here are some ways data analytics can boost your business:

- Find Bottlenecks: See where work is getting stuck.

- Predict the Future: Forecast sales, expenses, and cash flow.

- Catch Fraud: Spot unusual patterns in your financial data.

- Personalize Experiences: Understand what your customers want and tailor your marketing.

Tech to the Rescue: Automation is Your Friend

Tech is essential for optimizing your business. Automation tools can handle the boring stuff, reduce errors, and free up your team for more important things. From RPA (robotic process automation) to cloud accounting, there are tons of options.

Here are some examples:

- Invoice Processing: Automate receiving, approving, and paying invoices.

- Expense Reporting: Use software to streamline expense reports.

- Data Entry: Automate those tedious tasks with RPA or OCR (optical character recognition).

- Workflow Management: Automate routing tasks and approvals.

When choosing tech, think about your specific needs and budget. Is it easy to use? Does it work with your existing systems? Does it have the features you need?

Financial Reporting, Budgeting, and Forecasting: The Right Way

Accurate financial reports, budgets, and forecasts are critical for making good decisions. Here are some best practices:

- Clear Policies: Have clear, written accounting policies.

- Chart of Accounts: Use a good chart of accounts to categorize transactions.

- Reconcile Regularly: Reconcile bank accounts, credit cards, etc., often.

- Realistic Budgets: Create budgets based on reality, not wishful thinking.

- Forecasting Techniques: Use trend analysis and other techniques to predict the future.

- Monitor Performance: Track your actual performance against your budget.

Follow these tips, and you’ll have accurate, reliable financial data to guide your decisions.

Your Action Plan: Get Started Today

Optimization is a journey, not a destination. It’s about constant improvement. Here’s what you can do right now:

- Do a Process Audit: Find your key processes and see how they’re doing.

- Invest in Data Analytics: Start using tools to find insights.

- Explore Automation: See what tasks you can automate.

- Review Financial Reporting: Make sure your reports are accurate and timely.

- Encourage Improvement: Ask your employees for ideas.

By embracing these strategies, you can turn your business into a data-driven powerhouse. You’ll make smarter decisions, improve efficiency, and achieve sustainable growth. It’s an investment that will pay off big time.